Record-High Deficit May Dash Big Plans

$1.4 Trillion in Red Ink Means Less to Spend On Obama's Ambitious Jobs, Stimulus Policies

SOURCE: White House | The Washington Post

Discussion Policy

Comments that include profanity or personal attacks or other

inappropriate comments or material will be removed from the site.

Additionally, entries that are unsigned or contain "signatures" by

someone other than the actual author will be removed. Finally, we will

take steps to block users who violate any of our posting standards,

terms of use or privacy policies or any other policies governing this

site. Please review the full rules governing commentaries and discussions. You are fully responsible for the content that you post.

|

Saturday, October 17, 2009

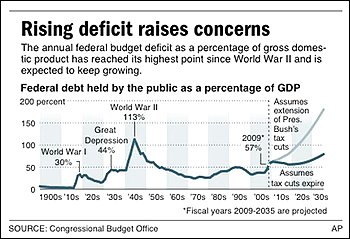

The federal budget deficit soared to a record $1.4 trillion in the fiscal year that ended in September, a chasm of red ink unequaled in the postwar era that threatens to complicate the most ambitious goals of the Obama administration, including plans for fresh spending to create jobs and spur economic recovery.

Still, the figure represents a significant improvement over the darkest deficit projections, which had been as much as $400 billion higher earlier this year, when the economy was wallowing in recession. Since then, the outlook has brightened and a government bailout has successfully stabilized the nation's troubled financial sector. In a report released Friday, Treasury Department officials said the government had spent $132 billion less than expected in August, due primarily to a drop in anticipated spending on the banking bailout.

At about 10 percent of the overall economy, the gap between federal spending and tax collections is the largest on record since the end of World War II, and bigger in nominal terms than the past four years of deficits combined. Next year is unlikely to be much better, budget analysts say. And Obama's current policies would drive the budget gap into the trillion-dollar range for much of the next decade.

As they unveiled the final 2009 figure, administration officials argued that expensive emergency programs -- such as the $700 billion bank bailout requested by the Bush administration and the $787 billion economic stimulus package Obama signed during his first days in office -- were essential to halting a frightening economic slide earlier this year. The deficit ultimately was lower than expected because those programs worked, they said.

But they tacitly acknowledged that the administration has yet to chart a clear path through the fiscal thicket.

"This year's deficit is lower than we had projected earlier this year, in part because we are managing to repair the financial system at a lower cost to taxpayers," Treasury Secretary Timothy F. Geithner said in a statement. "But future deficits are too high, and the president is committed to working with Congress to bring them down to a sustainable level as the economy recovers."

White House budget director Peter Orszag added: "The president recognizes that we need to put the nation back on a fiscally sustainable path." As Obama draws up his second budget blueprint, due to be delivered to Congress in February, Orszag said, "we are considering proposals to put our country back on firm fiscal footing."

Another Budget Go-Round

Orszag has already instructed federal agencies to identify spending cuts for next year's budget, but the report comes as lawmakers contemplate proposals that would drive spending even higher.

Congress is enmeshed in a deeply partisan battle over Obama's plan to overhaul the nation's health-care system, which would add billions of dollars to the federal budget, if not future deficits. Democrats also are considering extending safety-net programs for the unemployed, funding new job-creation strategies to combat a 9.8 percent unemployment rate and cutting seniors another round of $250 checks to make up for the government's decision to withhold cost-of-living increases for Social Security recipients. Meanwhile, Obama has said he wants to extend an array of expensive tax cuts enacted during the Bush administration that are set to expire next year. And Senate leaders hope to vote next week on a plan to block scheduled pay cuts for doctors who treat Medicare patients, a move that would add nearly $250 billion to deficits over the next 10 years.

With midterm elections approaching in 2010, Republicans are hoping to capitalize on the bleak budget picture and have cast Obama as a big-spending liberal looking to expand the reach of government into every facet of American life.

"There is no doubt we started the year in a difficult fiscal situation. But Congress and the administration have made a bad situation much worse with an unrelenting spending binge that has plunged our nation into a dangerous level of deficit and debt," said Rep. Paul D. Ryan (R-Wis.), the senior Republican on the House Budget Committee.

Added Senate Minority Leader Mitch McConnell (R-Ky.): "Congress simply can't continue acting like a teenager on a spending spree with his parent's credit card with no regard to who pays the bill."

Why Do I Have to Log In Again?

Why Do I Have to Log In Again? Discussion Policy

Discussion Policy